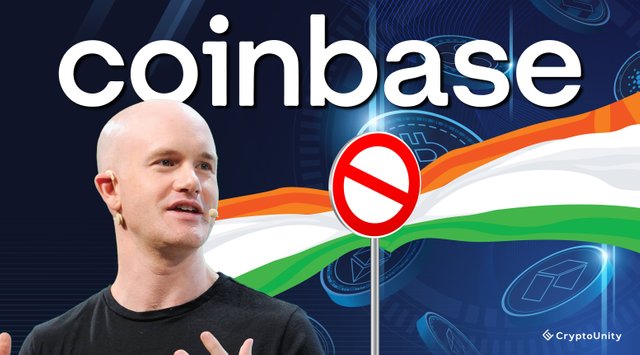

The Nasdaq cryptocurrency exchange Coinbase has revealed that it stopped operation in India a few days after its launch due to "informal pressure" from the country's central bank, the Reserve Bank of India (RBI) says CEO Brian Armstrong.

Coinbase revised its Indian operation during the Company's earnings call Tuesday, particularly why it exited the Indian Crypto market a few days after its launch.

Anil Gupta, vice president of investor Relations at Coinbase asked CEO Brian Armstong "Some shareholders" are curious about the recent developments in India. Can you explain the halting of UPI transfers there and what impact will that have on your expansion plans in the market?

Coinbase launched in India on April 7. Armstrong went to India for the launch. The company stated at the time that users could use the UPI system to buy cryptocurrencies on the platform. However, the company disabled the UPI option a few days later.

There's a lot of interest in crypto amongst the people there in India so we had an integration with what's called UPI and this was a great example of just our international strategy, Armstrong said during the earnings call. He explained.

Read full story at: https://cryptounity.news/coinbase-halted-trading-service-in-india-due-to-informal-pressure-from-rbi

Comments

Post a Comment